As estate planning and elder care law attorneys, we’ve dealt with a lot of situations—from common ones many of us will experience to more unusual ones. They all have common threads, specifically, key takeaways that could help other clients avoid sticky situations down the line. Here’s how to avoid 10 of the most common estate planning mistakes:

1. Sending Your Kid to College Without a Healthcare Power of Attorney

Twin XL sheets? Check. Bin full of snacks? Check. Healthcare Power of Attorney… wait, what? You won’t find it on any college packing list, but it should be. Many students will be living away from home for the first time—whether that’s across town or across the country. In the event of an emergency, your student—who is now over the age of 18—will no longer be treated as a minor. That means you won’t be able to make decisions for them in the event they’re incapacitated. Putting in place a Healthcare Power of Attorney will provide a safety net.

2. Creating Estate Planning Documents Online

Millions of others have done it, so what could go wrong? A lot, actually. Algorithms can only do so much. You can still end up using the wrong form or editing the document’s language in a way that contradicts other portions of your estate plan. Plus, should you need representation down the line, you won’t have a relationship with an attorney who can help. Bottom line: think twice before using websites that rhyme with Seagull Doom.

3. DIY-ing the Population & Execution of Your Estate Planning Documents

Like #2, we don’t recommend DIY-ing your estate planning offline either. Creating documents really ought to be done by an attorney. And, in order for your documents to be properly executed, you’ll need to have witnesses. There are requirements for who can and can’t serve as a witness and they vary by jurisdiction. An attorney can make sure it’s done correctly.

4. Over-reliance on a Will

A will alone will not help you avoid probate, nor can it implement a schedule for the distribution of your assets or help you reduce your tax burden. It’s a common misconception that a will is all you need, when in fact, wills have a number of limitations. In many situations, additional estate planning is required to ensure your wishes are carried out as desired.

5. Working with a Firm That Doesn’t Support What They Create

Many law firms will sell you the documents you need, but not provide the support necessary to ensure those documents work the way they should. For example, a firm might help you create a trust, but leave you to figure out how to adequately put your assets in it. Or, if you buy assets after the trust is put together, there’s no one you can rely on to help you add them. That’s why we provide no-fee phone calls and lifetime support for the plans we create.

6. Not Updating Your Estate Plan When Someone Passes Away

Understandably, updating an estate plan isn’t always on your mind following the loss of someone you love. But unfortunately, having an outdated estate plan only causes more heartache, especially if your beneficiaries, powers of attorney, schedule of assets and other critical documents are no longer correct. Even if you haven’t experienced a loss, it’s still important to revisit your plan at least every five years, because laws and procedures change.

7. Ignoring the Risk of Long-Term Care Costs

Most plans don’t address long-term care, which is coincidentally the largest risk to your estate. In fact, 70% of people over the age of 65 will need long-term care. Having a plan for how you’ll address those costs can ensure that a surviving spouse isn’t impoverished or at risk of losing the family home.

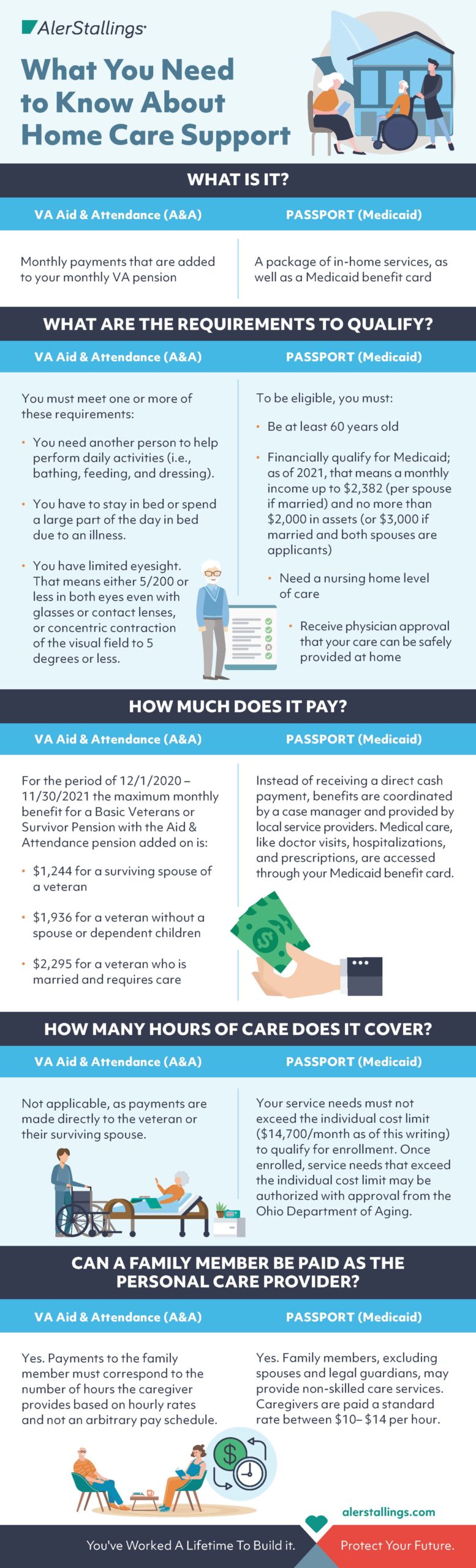

8. Using an Estate Planning Attorney Instead of an Elder Law Attorney

Estate planning attorneys address what happens after you die. But what about when you’re alive? That’s where an elder law attorney comes in handy. Elder law attorneys can address both scenarios and that’s important as you age. They can help with key issues in retirement, like protecting your assets and helping you access benefits you may be entitled to—like VA benefits or Medicaid.

9. Not Considering the Age of Your Attorney (in Relation to Your Own Age)

Simply put, you need an attorney who will be alive when you die. Hiring someone older than you could mean they retire or hand off their practice just when you need them most, leaving you in a lurch if you don’t have a relationship with their replacement.

10. Creating a Life Estate

A life estate gives you use of your property during your lifetime, then transfers ownership upon your death to the heir you’ve designated. Some people choose a life estate because it helps them avoid probate. However, life estates have serious drawbacks, like relinquishing your ability to make major decisions regarding your home. Additionally, they lack the tax advantages some of the alternative options offer. Many people don’t realize the government will want its cut in taxes before the property transfers.

What’s the best way to avoid these mistakes? Working with a trusted attorney who will be there to support you through every season of life. Learn more about how we serve our clients with heart, or get in touch to set up a complimentary phone consultation with one of our caring attorneys.