November 18, 2021 | Uncategorized

Get the Facts on What it Will (and Will Not) Cover

Wouldn’t it be great if Medicare were like an all-inclusive resort and whatever you needed was included? It’s probably not as fun to envision as cocktails poolside, but it’s still better than reality. In fact, what Medicare doesn’t cover may catch you by surprise, leaving you in a tough situation.

While you can always cut back on cocktails that cost extra, you can’t forgo care you need, especially when it comes to critical services like long-term care. The best remedy is being in the know about what Medicare does and does not cover so you can plan now and be prepared.

But First, a Clarification

Before we dive in, it’s important to distinguish the difference between Medicare and Medicaid. While both programs involve government healthcare, they’re administered by different entities. Medicare falls under the purview of the federal government, while Medicaid is a joint program between the federal government and the states. It is possible to be eligible for both Medicare and Medicaid; this is called dual eligibility. Depending on your income, you may find Medicaid will pay your Medicare Part B premiums, or you could continue to receive full benefits.

Speaking of Part B, let’s take a quick look at the Medicare alphabet soup. Your basic Medicare coverage, also called Original Medicare, consists of Part A and Part B. Part A provides hospital coverage. If you worked 10 years or more and paid Medicare taxes, Part A won’t cost you anything (aside from your deductible, coinsurance, and annual benefit caps).

Part B covers services deemed medically necessary (like doctor office visits, wheelchairs, x-rays, and lab work). It also covers preventative services—like your annual flu shot—and disease screenings. Your income determines how much you’ll pay in premiums and there is a small deductible as well as coinsurance.

If you want to receive hearing, vision, and dental benefits, you’ll need to purchase a Part C plan. These are offered by private companies approved by Medicare. Some Part C plans have prescription drug coverage, but if you purchase one that does not, it’s also available through Medicare Part D.

So, What’s Missing?

While that might sound fairly comprehensive, there’s one important service that’s not covered: long-term care. That’s a problem because long-term care has the greatest potential to throw a wrench in your retirement finances.

Medicare will pay for the first 20 days in a skilled nursing facility, and days 21-100 with a co-pay of $185.50 per day. After that, you’re responsible for all costs. Ideally, you’d be rehabilitated and return home. But some patients are unable to return home because their condition is not expected to improve. Instead, they’ll need to move to a long-term care facility.

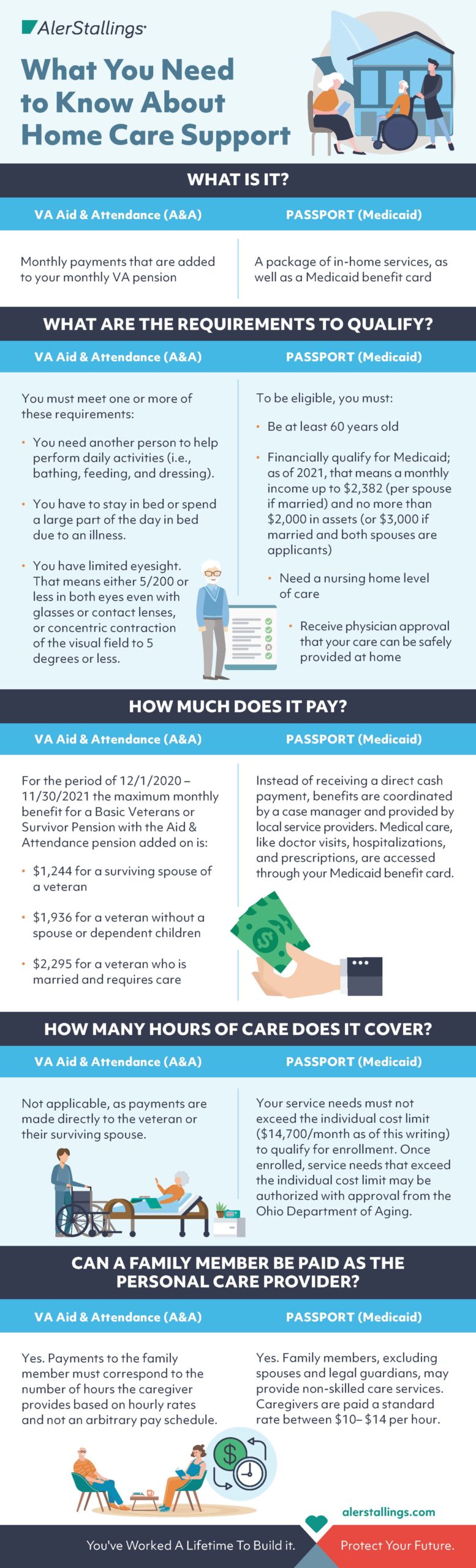

In this situation, it’s important to talk to an elder care attorney as soon as possible. You may qualify for programs that could help with the cost of care, like Medicaid, PASSPORT, and VA Aid & Attendance benefits. An experienced elder care attorney can navigate the application process and help you avoid errors that could result in delays or denials.

Planning Ahead

While no one can know for sure whether they’ll need long-term care, you can take actions now to protect your hard-earned savings from the possibility. An elder care or estate planning attorney can help you examine which options may best fit your situation, including legal tools like trusts. One popular trust for protecting against the cost of long-term care is aptly named the asset protection trust. It’s important to note, however, that your assets must be in the trust for at least five years to be fully protected. That’s why it’s never too early to consult a trusted attorney to develop your plan.

Now that we’ve taken the mystery out of Medicare coverage, let’s not take away all the fun. Feel free to resume your poolside cocktail daydream. And remember, should you need help demystifying Medicare and protecting yourself from long-term care costs, our caring attorneys are here to help. Get in touch anytime to set up a complimentary phone consultation.